Play Aviator Game Online: Top Real Money Casinos in India 2025

The Aviator game has reshaped India’s online casino scene with its fast-paced gameplay and high-multiplier potential. Thousands of players join daily, and this guide will show you how to start playing Aviator for real money the right way.

Understanding the Aviator Crash Game

Developed by Spribe and released in 2019, Aviator is built around a fast-paced crash mechanic. The gameplay is straightforward: you place your stake, the aircraft starts its flight, and the multiplier steadily increases. Your task is to withdraw your winnings before the plane disappears. If you fail to cash out in time, the entire bet is lost.

The game’s immense popularity in India stems from its transparency and thrill. Here are the key reasons for its success:

- Zero Learning Curve: The rules are intuitive. You can start playing immediately without needing complex guides, or simply try the Aviator demo mode first.

- Verified Fair Play: The game uses Provably Fair encryption, allowing players to independently verify that each round’s outcome is truly random and not manipulated.

- Multi-Device Compatibility: Aviator runs smoothly across desktop computers as well as Android and iOS smartphones for uninterrupted play anywhere.

- Intense Gameplay Dynamics: The balance between risk and potential reward creates constant excitement, pushing players to choose the perfect moment to lock in their profit.

Quick Facts: Aviator Game Online

| Title | Aviator |

| Provider | Spribe |

| Release Date | 2019 |

| Genre | Crash / Social Multiplayer |

| Regulatory Status | Licensed by UKGC, MGA, and others |

| Official Page | https://spribe.co/games/aviator |

| Bet Limits (INR) | ₹10 – ₹1,000 (varies by site) |

| Key Tools | Dual Bets, Autoplay, Live Stats, Chat |

| Mobile Support | Yes (Android & iOS) |

| Free Play | Demo Mode Available |

| RTP (Return to Player) | 97% |

| Fairness Tech | Provably Fair |

Top Indian Casinos to Play Aviator Game

1win

- Bonus Offer: 500% Match up to ₹80,400

- Highlights: Smooth interface, massive bonus package

4RABET

- Bonus Offer: 700% Crash Bonus up to ₹40,000

- Highlights: Great mobile apps, dedicated support

Mostbet

- Bonus Offer: 125% up to ₹34,000 + 250 Spins

- Highlights: Excellent FAQ, user-friendly design

Parimatch

- Bonus Offer: 150% Match up to ₹105,000

- Highlights: Organized layout, useful blog tips

Pin-Up

- Bonus Offer: 120% up to ₹450,000 + 250 Free Spins

- Highlights: Local Indian payments, huge library

Blue Chip

- Bonus Offer: 500% up to ₹100,000 + Free Aviator Bets

- Highlights: Specific Aviator perks, VIP club

Batery

- Bonus Offer: 150% up to ₹25,000 + 200 Spins

- Highlights: Top-tier game providers, clean UI

1xbet

- Bonus Offer: Up to ₹140,000 + 150 Spins

- Highlights: Massive promo section, phone support

Becric

- Bonus Offer: ₹100 No-Deposit Free Cash

- Highlights: Quick registration, no-deposit deals

Dafabet

- Bonus Offer: 160% up to ₹16,000

- Highlights: Crypto support, dedicated app

Top 3 Platforms to Play Aviator for Real Money

Although Spribe’s Aviator betting game is featured on many online betting platforms, the quality of these casinos can vary greatly. Important factors such as official licensing, mobile app support, and fast withdrawal processing should guide your choice. Based on these key criteria, we’ve selected the top three platforms best suited for Indian players:

1Win

1Win stands out as one of the most popular platforms for Aviator fans in India, with a community exceeding one million active users. The website is valued for its fast performance, clean design, and stable operation.

In addition to Aviator, players get access to a massive catalogue of 7,000+ casino games. A major advantage is that the Aviator demo can be launched instantly without registration.

New users receive an impressive welcome package of up to 500% reaching ₹80,400, while loyal players enjoy ongoing cashback deals and frequent tournament rewards.

| Founded | 2016 |

| License | Curaçao (No: 8048/JAZ 2018-040) |

| Banking | UPI, Paytm, GPay, Crypto (BTC, USDT), PhonePe |

| Min Deposit | ₹300 |

1Win delivers a seamless local payment experience by supporting popular Indian options such as Paytm, UPI, and PhonePe, along with leading cryptocurrencies. Most withdrawals are handled quickly and without unnecessary delays.

The platform is fully optimized for mobile gaming, offering dedicated apps for both Android and iOS so you can play Aviator game anytime, anywhere. Round-the-clock live chat support further strengthens user confidence and reliability.

4raBet

Since 2019, 4raBet has established itself as a top-tier betting site in India. It hosts thousands of slots and live games, but its Aviator game selection, including Lucky Jet and Aviator, is the real highlight.

What sets 4raBet apart is its dedicated “Crash Welcome Offer.” This 700% bonus up to ₹40,000 is designed specifically for crash game enthusiasts, usable on titles like Aviator. If you love the genre, this is arguably the best bonus in the market.

| Founded | 2019 |

| License | Curaçao (No: 8048/JAZ) |

| Banking | UPI, AstroPay, GPay, PhonePe, Crypto (ETH, BTC, LTC) |

| Min Deposit | ₹300 |

Is 4raBet legitimate? Absolutely. It operates under a valid Curaçao license, ensuring safety for Indian players. The platform focuses heavily on mobile usability.

You can download their specialized Android or iOS apps directly from the footer of their website, ensuring smooth Aviator sessions without browser lag.

Batery

Batery is quickly gaining recognition as a strong contender in the Indian casino market, featuring a massive collection of 10,000+ games. When players want a break from Aviator, they can choose from a wide range of slots and live dealer titles. The platform is built for fast performance and stands out with its diverse crash and specialty games.

Mobile performance is one of Batery’s strongest points, allowing smooth gameplay directly from any smartphone. New users are welcomed with a generous bonus package a 150% deposit match up to ₹25,000 plus 200 free spins with additional rewards spread across the first five deposits.

| Founded | 2023 |

| License | Curaçao (No: 153269) |

| Banking | Cards, UPI, Paytm, GPay, AstroPay |

| Min Deposit | ₹300 |

Batery places a strong emphasis on player safety by using advanced SSL encryption to protect all data and transactions. The platform supports a wide selection of payment options, including Visa and MasterCard, popular eWallets, and leading cryptocurrencies such as Ethereum.

With a minimum deposit starting from just ₹300, the casino remains accessible to both casual and low-budget players.

How to Play Aviator game: Step-by-Step Guide for Beginners

Aviator is a fast-paced game that blends chance with rapid decision-making. Although the mechanics are easy to grasp, understanding the timing and flow of each round is essential for smart play.

Before wagering real money, it’s important to learn how each stage of the Aviator game works.

Gameplay Mechanics

Understanding the core loop is essential. You need to know how to wager and, more importantly, when to exit.

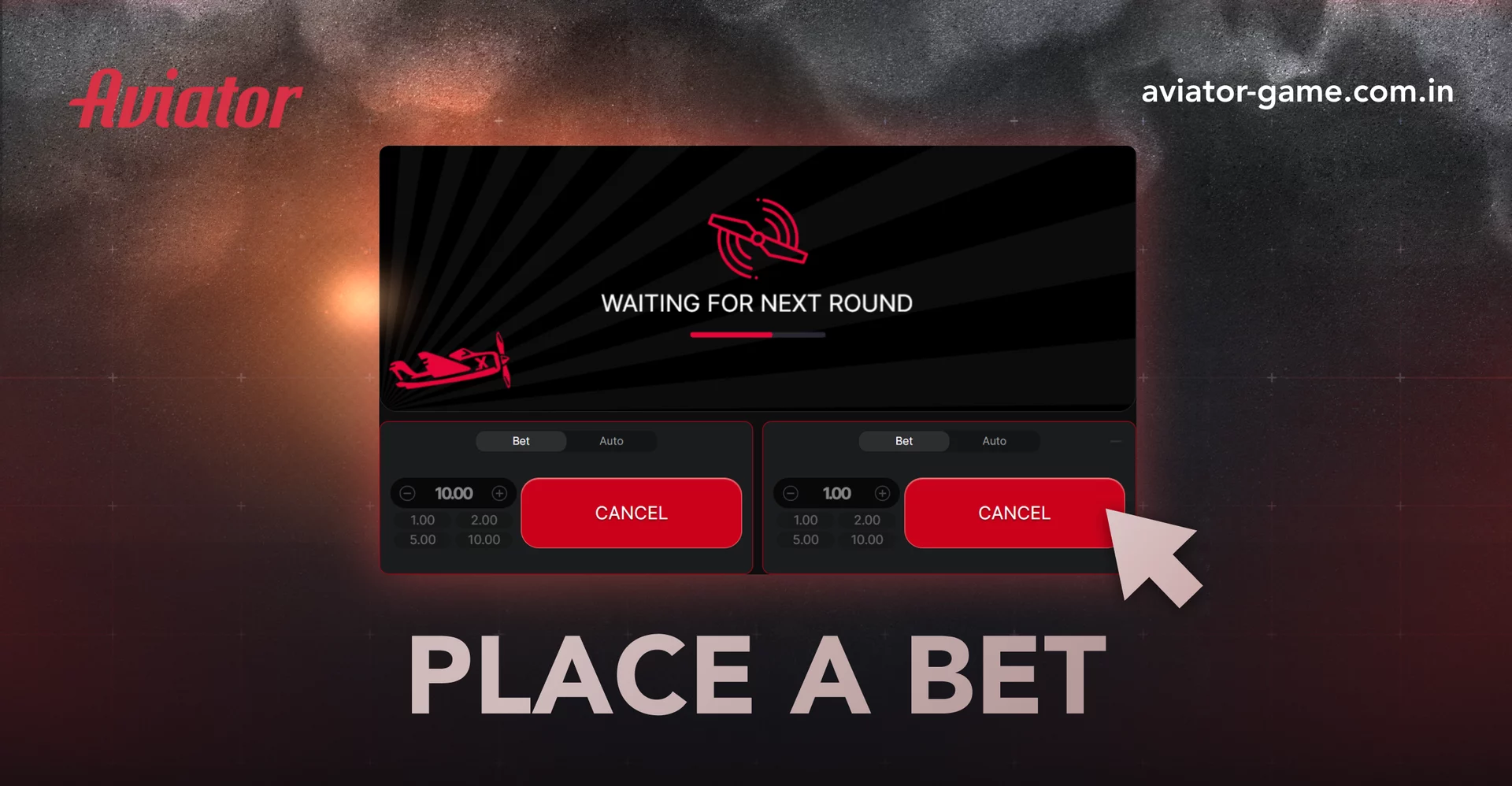

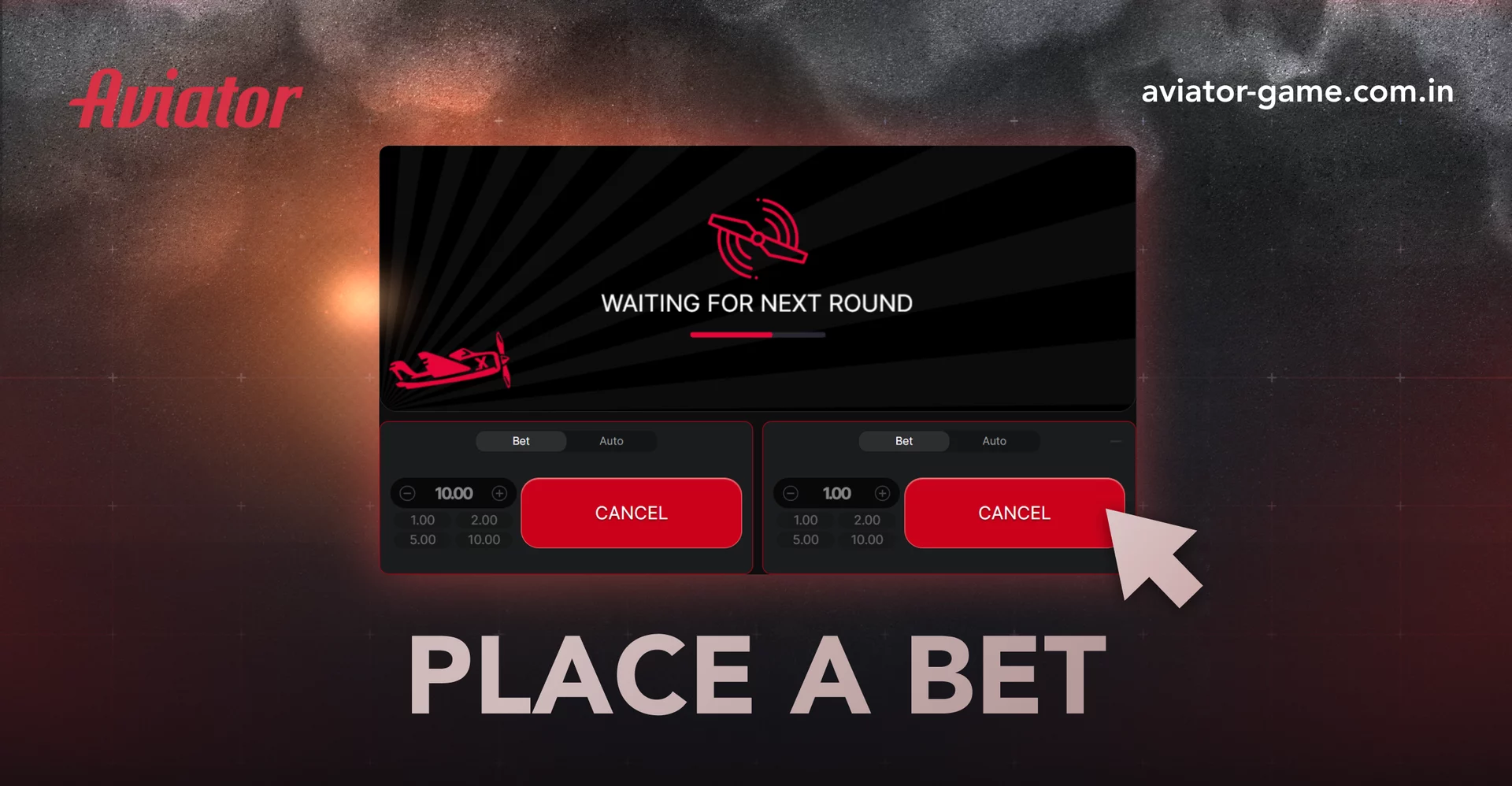

1. Place Wagers

Before the round starts, input your stake using the +/- buttons. You have about 5 seconds between rounds. For instance, a ₹700 bet cashed out at 10x yields ₹7,000.

Tip: You can place two bets simultaneously to split your strategy.

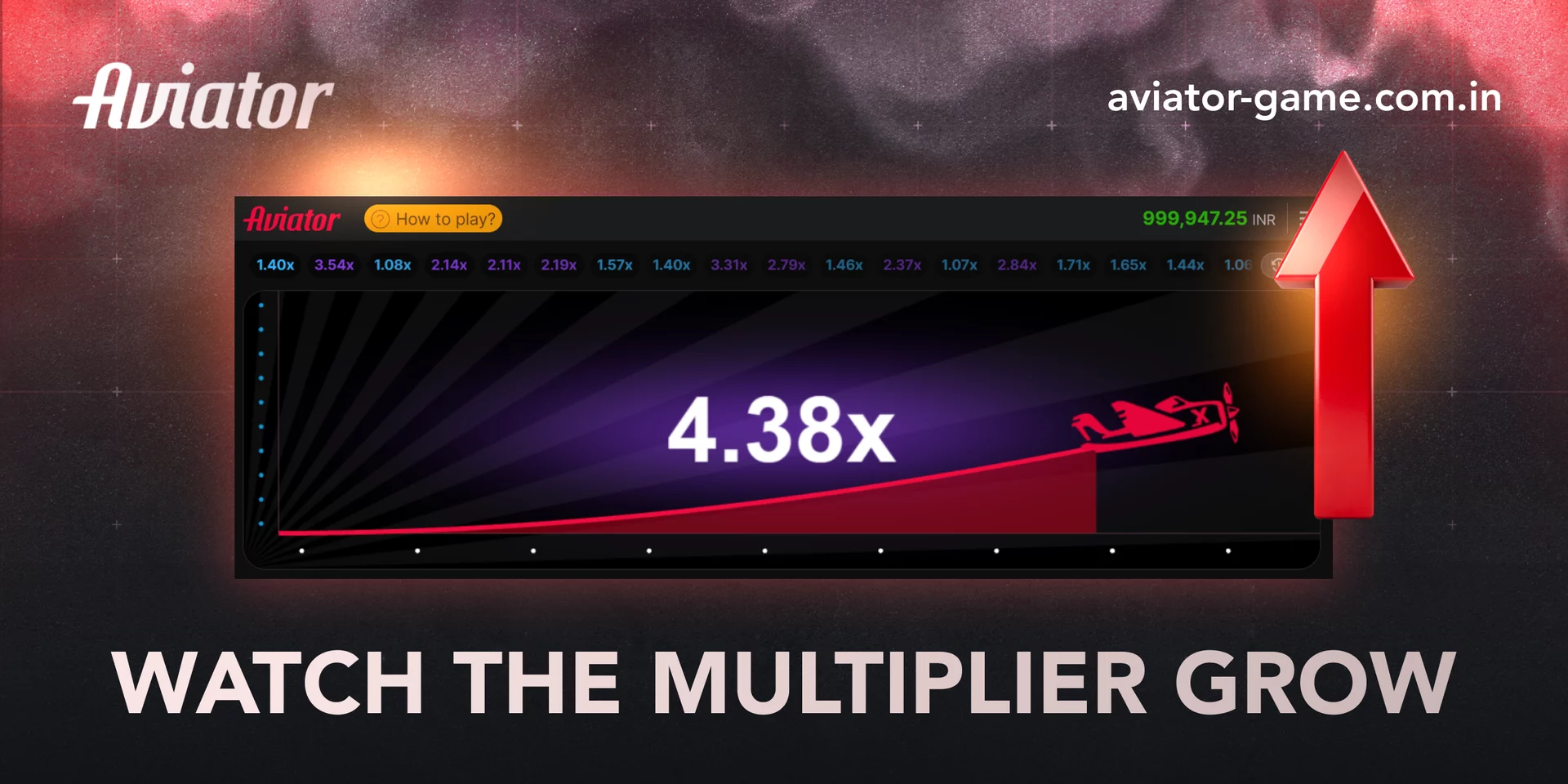

2. Track the Flight

Once bets close, the plane takes off. The multiplier starts at 1.0x and rises. The longer the flight, the higher the payout potential, but the risk increases every second.

3. Secure Winnings

This is the critical moment. Click “CASH OUT” before the plane flies away. If you are too late, you lose the wager. Timing is everything!

Try the Demo Mode

We strongly advise starting with the practice mode before placing real bets. Most trusted platforms let you access Aviator in demo mode using virtual funds.

This gives you the freedom to experiment with popular approaches such as Martingale or Paroli without putting any real money at risk, making it an ideal learning environment for new players.

Real Money Play

Once you feel ready to move beyond practice, you can transition to real-money play. Create an account on a reputable platform such as 1Win or 4rabet, fund your balance, and start placing live bets. Always define your spending limits in advance and keep responsible play as a top priority.

TRY AVIATOR DEMO

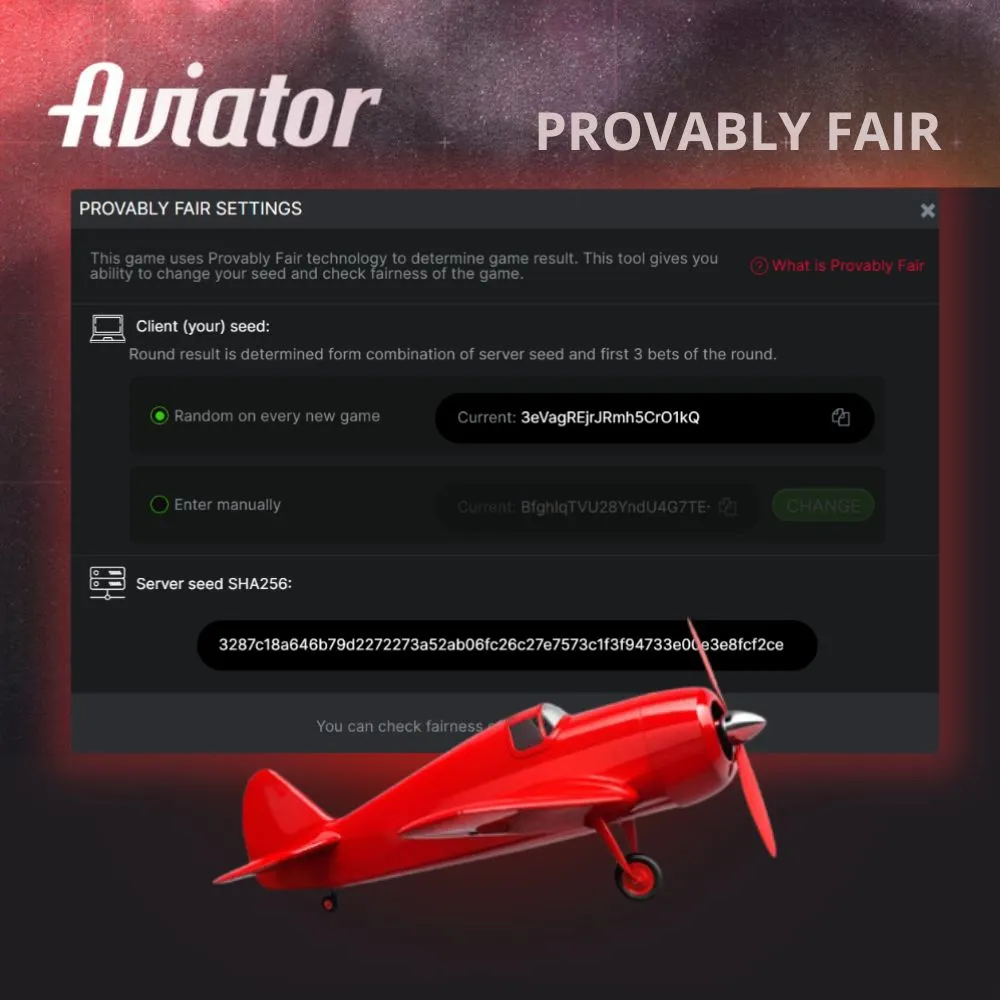

Provably Fair Technology: Why Aviator Can Be Trusted

Security and transparency are essential in online gaming, and Aviator delivers on both through its Provably Fair system. This advanced cryptographic technology allows players to independently verify every round’s outcome, guaranteeing that results are generated fairly and cannot be altered by the Aviator casino.

How the Algorithm Generates Results

The final crash outcome is not controlled by a single system. Instead, it is created using a combination of:

- A Server Seed (generated before the round)

- Multiple Client Seeds (contributed by the first active players)

This shared calculation model removes centralized control and prevents any party from pre-determining the result.

Step-by-Step Fairness Process

- Before the round begins, a cryptographic hash is created.

- The final crash point is calculated using both server and player data.

- Once the round ends, the original seed is revealed for verification.

- Because the crash value is mathematically locked in advance, no one can alter or predict it.

This structure eliminates the possibility of fraud or manipulation.

How Players Can Verify Any Round

Every Aviator round can be personally checked for authenticity:

- Open the round history inside the game

- Copy the displayed hash

- Paste it into any public hash-verification tool

- Confirm that the generated value matches the crash result

This gives players complete control over verification without relying on the casino’s word alone.

VERIFY NOW

Core Gameplay Tools and Functions

Aviator includes a set of built-in features that give players more control over risk and gameplay style. Learning how to use these options properly can significantly improve consistency and overall results.

Dual Bet Option

Each round allows two independent wagers. Many players use this to balance risk by locking in an early profit with the first bet while giving the second one room to grow for a bigger payout.

Automatic Cash-Out

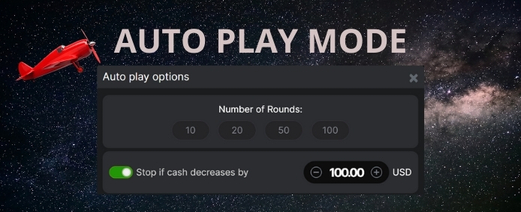

You can pre-set a target multiplier (for example, 2.00x), and the system will secure your winnings automatically once the plane reaches that level. Additional stop parameters can also be applied:

- Stop on loss: Halt autoplay if your balance drops by a set amount.

- Stop on win: Halt if your balance increases significantly.

- Stop on huge win: Halt if a single round win exceeds a specific limit.

This function is essential for maintaining discipline and avoiding emotional decisions.

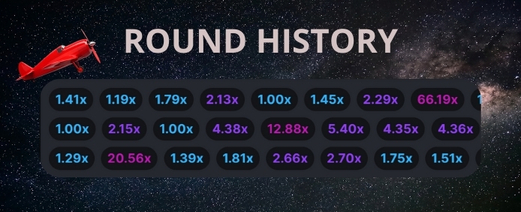

Previous Round Records

The top panel displays recent multipliers from past rounds. Although every round is generated independently, some players observe this data to help decide entry timing.

Auto Play Mode

By combining Auto Play with Auto Cash-Out, you can fully automate your session. Choose your stake size and let the system place consecutive bets without manual input.

Real-Time Betting Feed

Track live activity in the room by switching between:

- All players’ bets

- Your personal bets

- The highest recent wins

This adds transparency and helps you stay aware of overall game dynamics.

Aviator Live Player Chat

An in-game chat allows interaction with the community. Players exchange tips, react to big multipliers, and occasionally receive free bet drops through special chat events.

download app

Getting Started with Real-Money Aviator Play

Once you’re ready to move from practice to real stakes, it’s important to follow the right steps for a safe and smooth start. Use the simple guide below to begin your Aviator experience with confidence.:

Select a Casino

Don’t play on random sites. Choose a licensed operator from our recommended list above (like 1Win or Parimatch) to ensure your withdrawals are guaranteed.

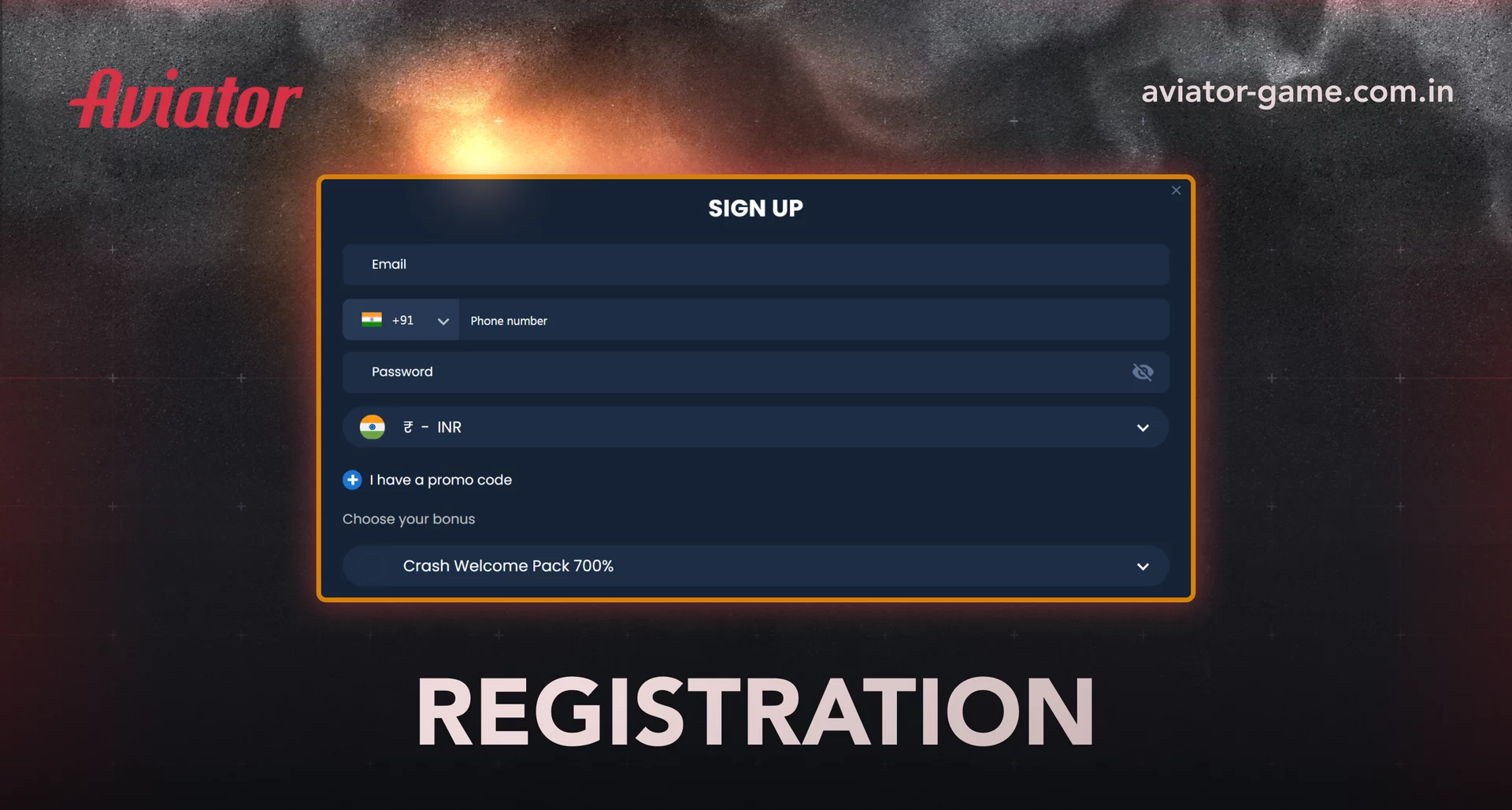

Sign Up

Click the “Register” button. Most Indian casinos allow one-click registration or sign-up via social media/phone number, taking less than 2 minutes.

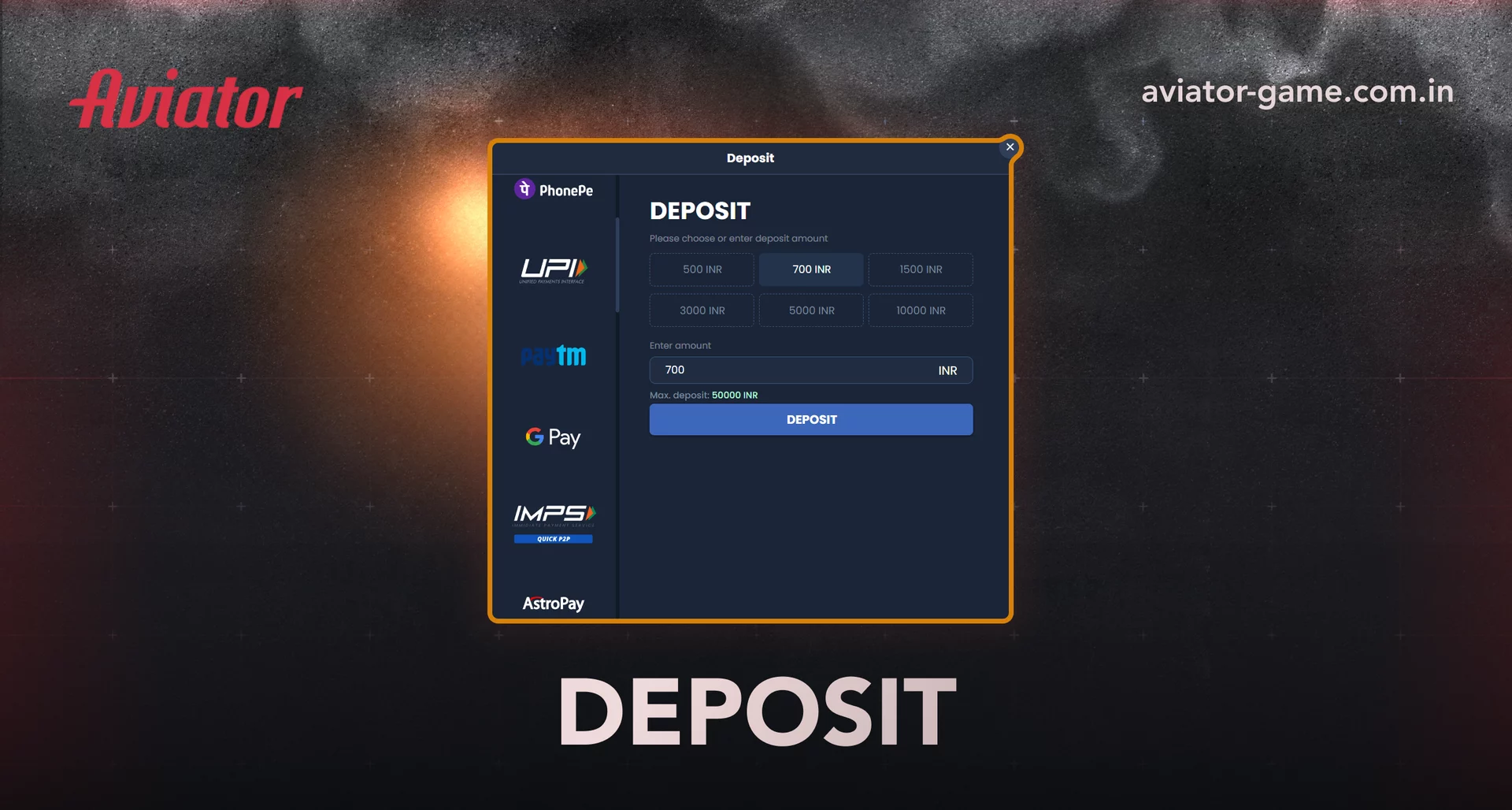

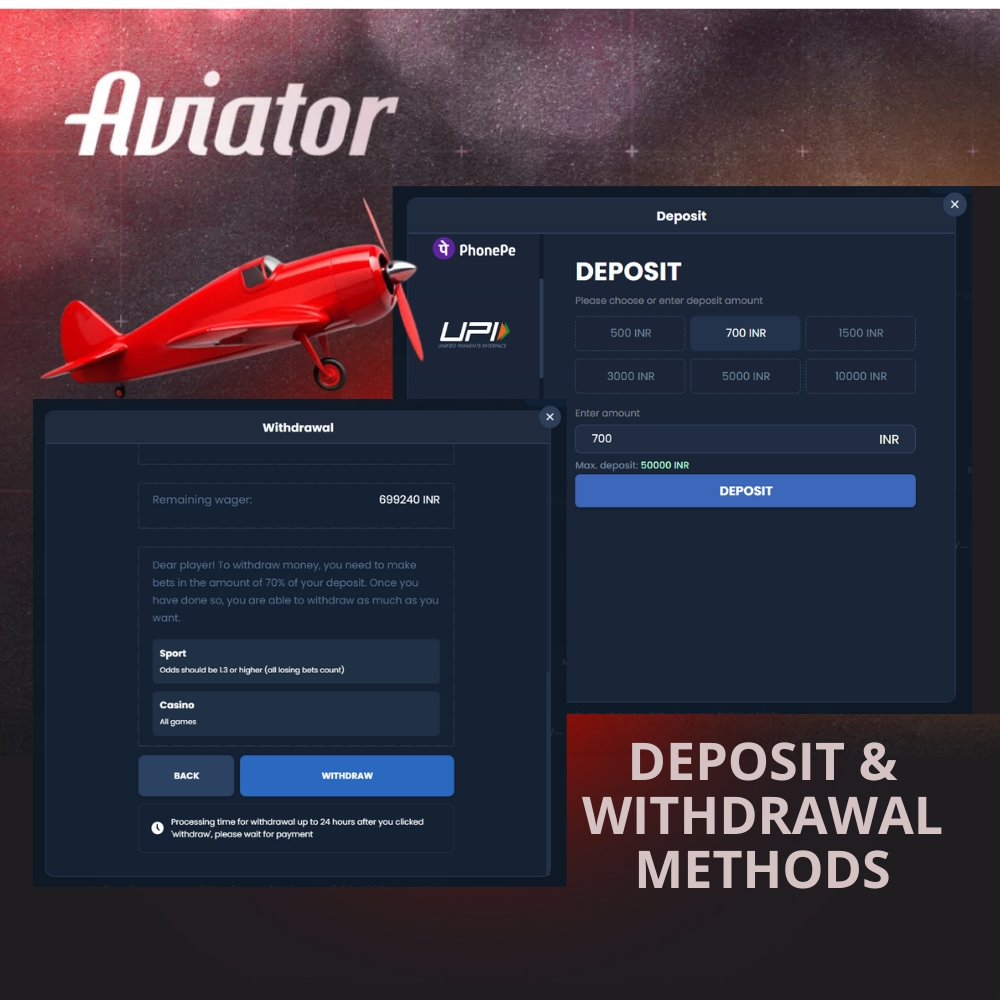

Deposit Funds

Navigate to the cashier. Select a method (UPI, PhonePe, Paytm) and deposit. Funds usually appear instantly, often triggering a welcome bonus.

Place Bet

Find Aviator game in the menu. Enter your wager amount (e.g., ₹100) and hit “Bet.” Wait for the round to start and cash out before the crash.

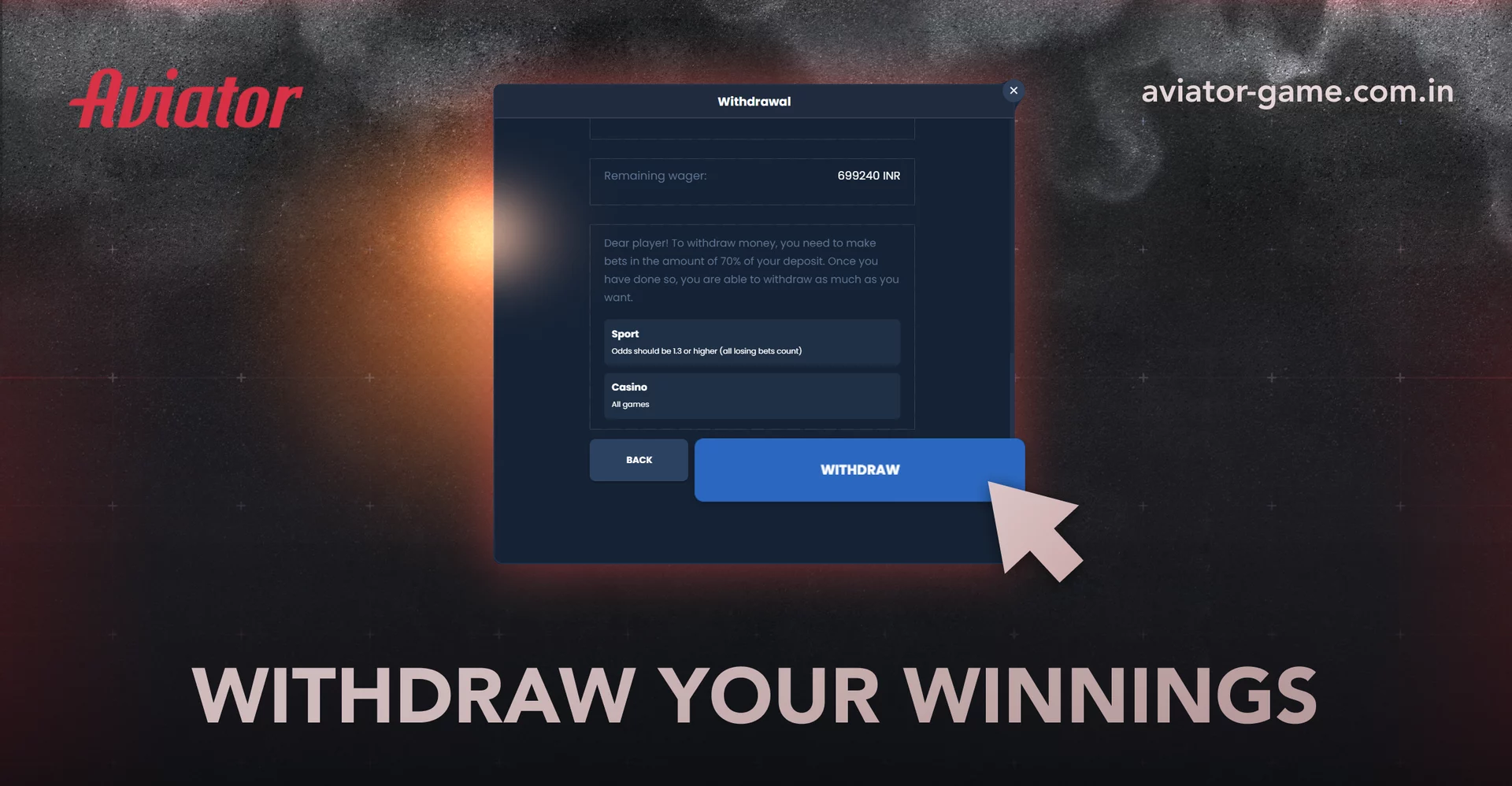

Withdraw

Won big? Head back to the cashier, select “Withdraw,” and choose your method. E-wallets usually process payouts within hours.

Available Indian Payment Options for Aviator Online

Here are the most common secure deposit and withdrawal methods you can use:

| Method Type | Description |

| Cards (Visa/MasterCard) | Standard banking options accepted for deposits universally. |

| UPI / IMPS | The most popular instant payment system in India, linked directly to your bank. |

| Mobile Wallets | Apps like Google Pay, PhonePe, and Paytm offer lightning-fast transactions. |

| Cryptocurrency | Bitcoin, Tether (USDT), and others allow for anonymity and high limits. |

| Net Banking | Direct bank transfers for those who prefer traditional security. |

Smart Winning Approaches & Betting Systems

Although Aviator is driven by randomness, structured betting methods can help you control risk and protect your balance. Below are four well-known systems that experienced players often use to manage their gameplay.

Fibonacci Strategy

This approach is based on the famous number sequence: 1, 1, 2, 3, 5, 8, and so on. After every loss, the stake moves one step forward in the sequence. After a win, you step back two positions. Compared to aggressive systems, Fibonacci grows bets more smoothly and is better suited for players with limited bankrolls.

Paroli System

Paroli works as the opposite of Martingale. Instead of increasing after losses, you raise your stake after each win to maximize hot streaks. Most players reset to the original bet after two or three consecutive wins to secure profits and avoid overexposure.

Martingale Method

This high-risk strategy requires doubling the wager after every losing round. One successful round can theoretically recover all previous losses and add a small profit. However, it demands a large budget and comes with a serious risk of hitting betting limits or exhausting your balance quickly.

D’Alembert Strategy

A safer alternative to Martingale. You increase your bet by one unit after a loss and decrease it by one unit after a win (e.g., from ₹20 to ₹30, then back to ₹20). This smoothes out variance.

TEST STRATEGIESTop Aviator Bonus Offers 2025

One of the biggest advantages of playing Aviator online in India is access to special casino rewards designed specifically for fans. The most attractive offer for new users is usually an aviator game bonus that boosts your first deposit and gives you more chances to test different strategies with real stakes.

After creating an account, many platforms activate an aviator sign up bonus automatically, while others require entering a specific promo code for aviator game during registration. These offers can significantly increase your starting balance, but it’s important to always check wagering requirements and time limits before accepting any promotion.

Below is a quick overview of the most common types of Aviator-related bonuses you may find on Indian casino sites:

- Welcome bonus: A percentage match on your first deposit (for example, 100%–500%).

- Reload bonus: Extra funds on subsequent deposits after sign-up.

- Cashback offers: A portion of your losses returned as bonus money.

- Free bets: Fixed-value bets you can use directly in the game.

- Tournament rewards: Prizes for leaderboard positions during Aviator events.

While bonuses can extend your playtime and improve your chances to catch a high multiplier, they are not free money. Most promotions come with wagering conditions that must be met before any winnings can be withdrawn. For this reason, always review the bonus rules carefully: minimum odds, wagering multipliers, and expiration dates can vary from one platform to another.

Used wisely, Aviator game bonuses are a powerful tool for building your bankroll and reducing early risks. Just remember to combine promotions with proper bankroll management and disciplined cash-out decisions for the best long-term results.

To maximize your playtime, we’ve compiled the best welcome offers for Indian players. These bonuses significantly boost your initial bankroll.

| Casino Brand | Current Welcome Deal |

| 1Win | 500% Deposit Match up to ₹80,400 |

| 4rabet | 700% Crash Game Bonus up to ₹40,000 |

| Mostbet | 125% Bonus + 250 Free Spins |

| Parimatch | 150% Slots Bonus up to ₹105,000 |

| Pinup | 120% Welcome Pack up to ₹450,000 |

| Bluechip | 400% Pack + Free Bets |

| Batery | 150% Bonus up to ₹25,000 |

| 1xBet | Mega Package up to ₹140,000 |

| Becric | ₹100 Free Cash (No Deposit) |

| Dafabet | 160% First Deposit Bonus |

Responsible Gambling

Gambling should always be entertainment, not a way to make money. Aviator game is fast-paced, making it easy to lose track of time and funds.

We urge you to use the safety tools provided by our partner casinos, such as deposit limits, loss limits, and self-exclusion options. If you feel you are losing control, organizations like Responsible Gambling Council offer free support and counseling.

download app

Is Aviator game Legal in India?

India does not have a single nationwide law that directly regulates online casino games, which places titles like Aviator in a legal gray zone. Since there is no central ban on online betting, most Indian players access Aviator through offshore platforms that operate under international gaming licenses. These casinos are legally registered outside India and are generally available to users from most Indian states.

However, gambling legislation is regulated at the state level. Regions such as Telangana and Andhra Pradesh enforce strict prohibitions on real-money gaming, while many other states allow players to use foreign platforms without restriction. This is why it is essential to understand the local legal framework before registering.

Many players also ask is Aviator game safe, and the answer largely depends on the casino you choose. Licensed platforms use encrypted connections, verified payment systems, and fairness audits to ensure player protection. To minimize risks, always play only on trusted, regulated websites and follow responsible gaming practices.

References:

FAQ

Can I really win money on Aviator?

Yes, you can earn real money in Aviator. When you place a real-money bet and successfully cash out before the plane crashes, your winnings are instantly credited to your casino account. However, like all gambling games, profits are never guaranteed and depend on timing, discipline, and bankroll management.

Is the Aviator game rigged?

No, the game is not fixed. Aviator runs on Provably Fair cryptographic technology, which means every round result is generated in advance using encrypted algorithms. Players can independently verify each crashed round, proving that neither the casino nor the provider can alter outcomes.

What is the maximum payout?

In theory, the multiplier in Aviator has no hard limit. In practice, most casinos apply a maximum payout cap per round. Still, it’s not unusual to see multipliers reach 100x, 500x, or even above 1,000x, depending on the platform’s limits.

Can I play for free before risking money?

Yes. Most online casinos offer a Aviator demo or fun mode where you can play with virtual credits. This lets you understand the mechanics, test strategies, and practice timing without risking real money.

How fast are payouts from Aviator winnings?

Withdrawal speed depends on the casino and payment method you use. With popular Indian options like UPI, Paytm, and IMPS, payouts are often processed within minutes to 24 hours after a successful withdrawal request.

Is Aviator a game of skill or pure luck?

Aviator is mostly a chance-based game, but player decisions still matter. While you cannot predict the exact crash point, choosing when to cash out, managing your bets, and controlling your emotions directly affects long-term results.

How do multipliers grow during each round?

The multiplier rises from 1x upward, and the system that powers the Aviator game creates different growth speeds each round, making the experience unpredictable.

Can I trust the results shown in the Aviator game?

The provider uses a Provably Fair system that generates encrypted outcomes before each round starts. This lets players independently verify that results were not modified.

Why do some rounds end almost instantly?

Instant crash moments are normal, and the fairness model behind the Aviator game ensures these early stops appear randomly to prevent predictable patterns.

How do bonuses work for new players in casinos that offer the Aviator game?

Many platforms provide welcome offers that can be used on this title. These bonuses often match your first deposit or include free credits for testing the gameplay.

Can two cash-outs be made in the same round?

Yes. The game allows placing two bets simultaneously and cashing them out at different moments, which helps balance low-risk and high-risk decisions in a single round.

What devices support the Aviator game?

You can run it on most modern smartphones, tablets, and PCs. The lightweight interface loads quickly even on average mobile networks, making it accessible anywhere.